As most know, I am expecting an eventual bear market that will last 2 years or more. Any bull market that ensues when the bear market ends, will be tepid compared to any that has been experienced in the 2000s.

As most know, I am expecting an eventual bear market that will last 2 years or more. Any bull market that ensues when the bear market ends, will be tepid compared to any that has been experienced in the 2000s.

I am still expecting a severe permanent depression, simply because a country cannot plan its way into a recovery. This will be the first economic downturn in American history with the absence of free market influences.

The inflation being experienced will eventually give way to deflation. As often mentioned, I don’t use quantitative analysis in my work as an economist. I focus on the natural law that creates the numbers others have so much confidence in. Inflation will cease and reverse even though there is mountains of unearned money in the upper echelons of the economy. Only the rich have money. Countless others are up to the necks in credit card debt and have no cash to spend. There are products on the market but little to buy them with. Prices will start dropping. All except the rich buy those things that are going up in price. There are plenty of substitutes. Much is spent on entertainment and other non – essentials that can be removed from budgets.

The Stock Market Today

Unlike others, I see the market being manipulated on a second – by – second basis by the high frequency firms. These firms are an abomination to a genuine market. They would not be allowed if they did not contribute positively to the bullish case.

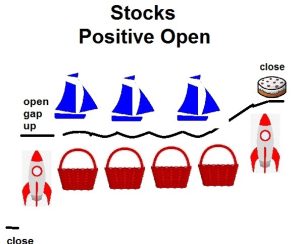

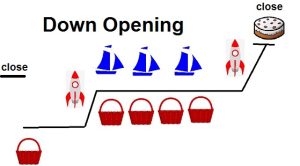

The images below – previously posted, show the two basic intraday patterns that have occurred of 90% of the days the market has been open over the past 10 years or so. For these patterns to be effective, there has to be low volume and little conviction in the selling. The overwhelming majority of trades must be intraday. Long – term holding must be kept from hitting the floor. This can easily be accomplished by alerting the biggest players that the market is about to be goosed and they will have a better opportunity to sell at better prices. I think it happens that way. Also, the trading public must not notice. Amazingly they don’t.

As of now, the normally bearish seasonal pattern reverses. Each year, efforts are made to contain selling and then initiate a short squeeze to to end the downtrend slightly before the bearish seasonal pattern ends. That effort has fallen short of being effective this year. Also, when prices are effectively managed, the intraday volume pattern makes a clean parabola shaped pattern. That ongoing effort so far has fallen short. Volume spikes in the middle of the day are a sign their plan is not working perfectly.

Normally a selloff of the kind we are seeing ends on heavy volume, often with a one day reversal. Volume is too light at this point to launch a new sustainable uptrend. When a new downtrend begins – if volume surges, that will mark an acceleration of the downtrend and it should last. It is hard to pronounce a bear market to be sold out when volume is as low as it has been so far. The next leg down may begin with a record volume day, much like what occurred in 1929.

I will be surprised if something of that nature does not occur. With a market like this, I am often surprised, however.

Of course, we will see a number of stunts designed to save the market. I wrote an article some time back entitled “Can The United States Survive a bear market? If I can find it I will add it below. Can The United States Survive a Bear Market?

I am up to 11 readers since my original blog was cancelled. There must be something mighty threatening in the content of this blog. Why else would such a small player be shut down?

Visits: 37

My basic working premise is that Baby Boomers will have their 401(k)/IRA/Roth IRA money stolen from them to as high a degree as is possible because it is simply too huge a wad of gated money for Wall Street (and their partners in government) not to steal. The last time I looked at demographic trends – if memory serves – the highest number of Baby Boomers who are hitting the mandatory withdrawal age of 70 1/2 years is occuring in 2024-2025 (give or take). That tells me Wall Street will tank the market and buy their stock holdings for pennies on the dollar shortly. Would you tend to agree with me, James? Or is there something I am not seeing?

Good point.