Technical Analysis had its beginnings in the early part of the twentieth century. In 1948, Technical Analysis by Edwards & Magee was published. For years, this served as the bible of chart analysis. The logic in the book is that fundamental analysis is unproductive because it is impossible to gain enough knowledge about corporations to know more than other value investors. It made sense to study the behavior of investors who used fundamentals as opposed to studying the criteria they were using.

Technical Analysis had its beginnings in the early part of the twentieth century. In 1948, Technical Analysis by Edwards & Magee was published. For years, this served as the bible of chart analysis. The logic in the book is that fundamental analysis is unproductive because it is impossible to gain enough knowledge about corporations to know more than other value investors. It made sense to study the behavior of investors who used fundamentals as opposed to studying the criteria they were using.

Back in the old days, only a small percentage of investors used chart analysis. Far more trades were long term in nature. This begin changing big time in the 1980s. In today’s markets, most trading is intraday. Technical Analysis became so popular that traders now are not observing the behavior of long term investors. They are unwittingly watching themselves. I was very early in noticing that stock prices were being heavily manipulated. Chart patterns which were quite productive in the past now serve as traps. According to traditional logic, when an uptrend line is broken – that is a signal to sell or to short. In modern times it ushers in a short squeeze and the uptrend is continued. I stopped using technical analysis in 2011. Had I continued, I would probably be homeless.

Technical analysis is still useful when it doesn’t involve a market where assets are trading.

Regular readers, may have read the article, The Coming Tech Train Wreck. That article makes the case for the demise of big tech in days to come. I also wrote an article entitled, How to Take Over the World in the Modern Era This article makes the case that there is in fact, an effort to take over the world by capturing the world’s factors of production by way of the financial markets. The military is now old school. Of course that doesn’t work with China, Russia, Iran and a number of others. The appearance is that these countries will be subdued by way of NATO and the U.S. military.

The elite now face some unexpected headwinds. Tech is falling apart. The public is now slowly fathoming that organized crime has taken over the healthcare industry. Remember buybacks? It now seems a perpetual bull market is not possible. All stock that is treasury stock is working against corporations as stocks fall while they contributed to corporate profits previously.

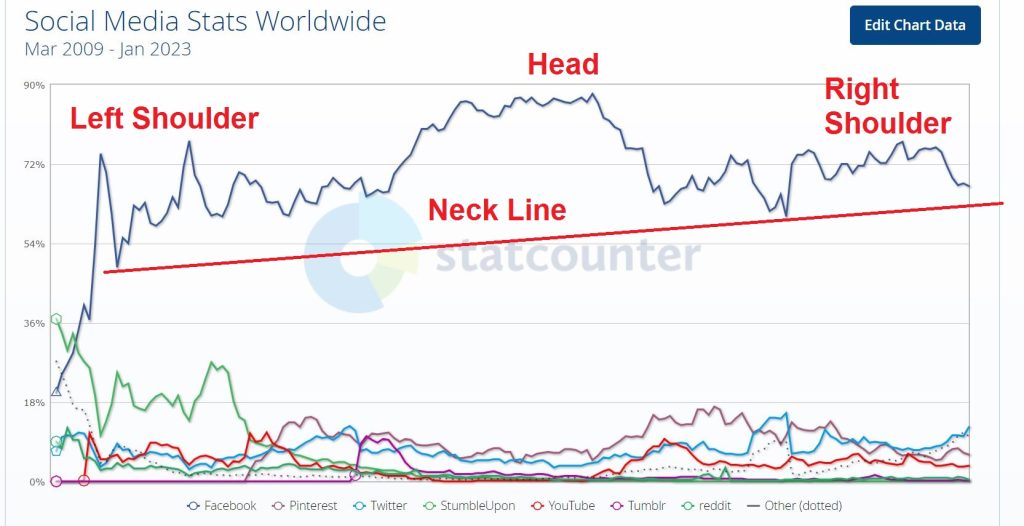

Here is where technical analysis is useful once again. Look at the chart of social stats over time. It is not at all hard to notice the long term head and shoulders chart of social media in general. My observation is that when that neckline is broken, the party for our betters is over. There will be no corporate world takeover after all. It can’t be done without the influence of big tech.

Views: 203

Well this is a hopeful sign! Social media is generally a pox upon humanity. If people pull away from it , reject it, and connect more on a personal, face-to-face way without a Big Business and/or Big Government middle man I would DEFINITELY consider that progress! YAY!!

I am always reluctant to suggest passing a law. There is one that is necessary. That would be a law requiring media companies to be stand alone organizations that cannot be subsidiaries of other corporations.