In theory,the stock market can go down. Which matters most, theory or reality? Here is the reality. When ten percent of the population own ninety percent of all stock, they can push stocks around as easy as pushing jelly around on a plate. There has been an ongoing successful effort for decades to consolidate stock ownership of assets, especially stock. There has to be a reason for that. The obvious reason is to control stock prices.

In the light of reality then, how might stock prices actually fall, for big tech for example? They could start losing money in their own business enterprises while new businesses emerge. That will happen but not anytime soon. Public opinion could turn against them and put a spotlight on what they are doing, People are born to trust. That will take some time also. There are many scenarios but little evidence of any of them now. Market volume is kept low purposefully and almost all volume is intraday. Economic stress may cause long term holdings to start hitting the market. High frequency firms prefer short term trading which makes it easier to create and maintain uptrends.

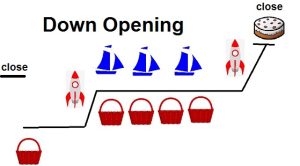

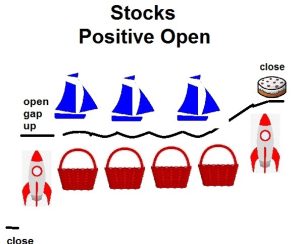

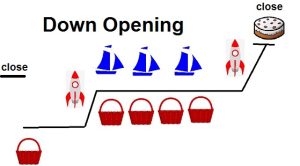

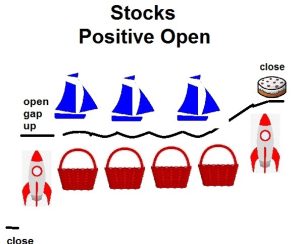

How do we tell if a selloff is going to continue and develop legs? Everyday, traders will notice a certain phenomenon that is visible on intraday charts of the averages. Each day has either a basket or a parachute in place. On the opening, if it is down, there is a basket where prices will stabilize. From there the high frequency firms milk prices higher into the close. If the market gaps up, there will be a parachute that holds prices steady. From there, high frequency firms again milk prices higher or at least assure a positive close.

When these manipulation tools start disappearing from the charts, then a decline may have legs.

Views: 29