On August 12, I posted the following article.

On August 12, I posted the following article.

Fall Stock Market Manipulation Update

This is an update to those observations and expectations.

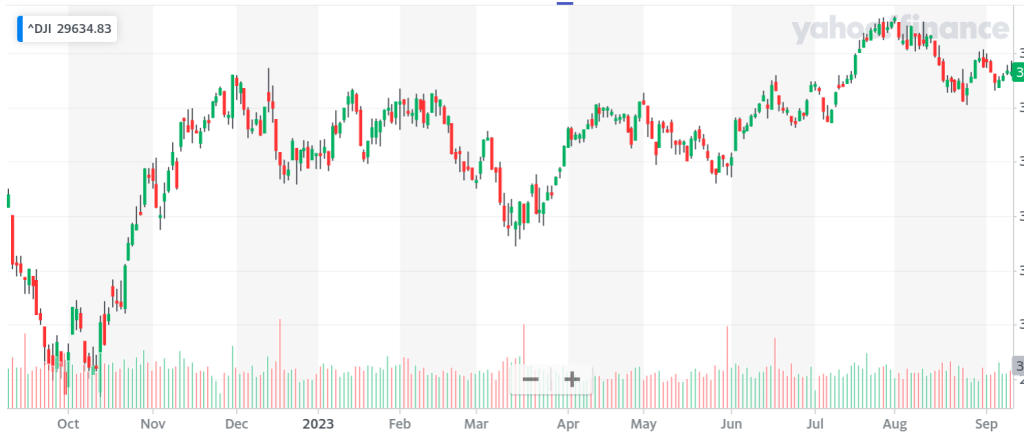

From now until mid October, expect repeated all appearances to indicate that the uptrend line on the head and shoulders is about to give way. With respect to stock market manipulation, our betters only run a hand full of plays. This has been going on for at least two decades. That is all they need, knowing that all others view the financial markets as mostly pristine though, influenced by Fed policy and a few other things. What this accomplishes for our betters is to draw in shorts and wear them out with ominous looking market patterns. The whip them hard. Keep whipping them and watch them cover.

Were price to slice through the neckline like a sharp knife, that indicates a change our betters can’t handle.

So far volume is still light, although does not make a near perfect parabola. If volume picks up considerably, our betters could be in trouble. To control the market, volume must remain light.

So far, there has been no stunt. I am now expecting that to happen towards the end of the second week of October. The appearance as of now, is that the averages will be caused to hug the neckline of the head and shoulders pattern developing for a good while. The pattern is obvious. Mid October marks the lowest level of the negative fall seasonal pattern

Traders, both armature and professional still rely on technical analysis. Most likely, the head and shoulders technical pattern will break its support line during mid October. Technical analysis is no longer a useful tool other than a way to compare price levels. There are two reasons for this. technical analysis evolved as a tool whereby, traders could study the behavior of long term and intermediate term investors. Nowadays, the vast majority of trades are intra-day. Machines have taken the emotional element out of the market. The fact that the market is totally manipulated turns it into a tool for manipulation. A bear who relies on technical has about the same lifespan as a gut shot confederate soldier.

The financial news is highly coordinated. So is social media. It is no accident that YouTube is completely filled with doom and gloom presentations. No bullish stunt can be successful without short positions in place, ready to be squeezed. We must not forget the ebb and flow of provocative news stories. They dispense of them when the public’s reaction fails to go as expected. If one rabbit of a news story is pulled out of the hat again, I expect it will be the alien story. The fact that all that was treated as relevant was the military usefulness of anti-gravity technology is telling. It is never sited as being a solution to the global warming issue. Nothing was ever discussed regarding anything else the aliens had accomplished.

If there is a stock market stunt this fall, I will not be surprised if it is alien related. There is one unanticipated problem our betters are facing. I don’t think they anticipated that as a response to censorship and mind control, the public would become so docile that they never get excited about anything.

Note: Fantasy Free Economics is banned in the United States. I am now hosting with Smartway, which is offshore. From the positive results I have gotten, I would host with them regardless. I encourage all to ask themselves – have you ever read anything here on Fantasy Free Economics that could be deemed unfit for the common person to read? Is there any content that is a threat to national security?

The only way to rebuild the readership of Fantasy Free Economics is for those who read it to share the link to the blog and certain articles. Email is best. It cannot be censored. There are still sites which accept the link. Try it and see.

James Quillian is not Tucker Carlson. I wish him well – as I hope all do. When a famous person get censored, he has the resources to make hay over the situation. I have no such resources. I must be frugal – just to meet my expenses. If you like these ideas, I hope you will participate by at least sharing the link.

The Fantasy Free Advantage is a PDF book explains the reasoning behind the fantasy free approach.

Common Thinking Errors This article provides a genuine shortcut to thinking and analyzing in the light of reality.

Views: 138