Stock Market Scheme of Things 02232024 Thru Spring PDF Version

Stock prices are still being managed successfully. Nothing significant to the downside will occur as long as that is the case. If and when that changes, the indexes will drop.

As it is, these are the key factors.

Anytime a major financial institution or elite player gives a bearish warning, a short squeeze is in the offing. As long as minor league pundits on YouTube broadcast that a crash is imminent, it is not going to happen. As long as traders, investors, economists and all others explain market action in terms of normal market influences, nothing is going to change.

Decisions to buy, sell or hold are made using technical analysis. Technical analysis evolved as a means by which technicians could study the behavior of those making decisions based on fundamentals. Today, fundamental analysis is mostly not used. By using technical analysis, all who use it are watching themselves and others who think just like they do. Machine trading has made the use of cycles unproductive. We have at least two generations of traders who have never traded in an honest market. Today’s aberrations are normal to almost all who trade, amateur and professional. They all rely on traditional trading tools regardless.

A market does not naturally rise on low volume, High volume makes it very difficult to manipulate prices. The fact that volume is low and trades are mostly intraday, makes it easy to maintain an uptrend.

The term “Don’t fight the Fed” doesn’t mean a lot these days. The Fed is guided by political pressure. It is difficult to stay in line with Fed policy, since not even the Fed itself knows what its policy actually is.

Americans on balance trust government to make better decisions for them than they can make themselves. If this were not true they would not support candidates as if they are picking messiahs to guide them into the future. Political arguments are limited to what is superficial. Usually, voter’s political arguments are nothing but sound bites that sound right to them. They adopt these notions as their own insight. None have even heard of the delegate model of representation. Basically, they want representatives to make decisions for them. These irrational behaviors are all part of the huge reality gap which will slam shut on them, just like atmosphere filling the gap in the atmosphere a lightning bolt creates. That, in fact, makes a mighty loud noise.

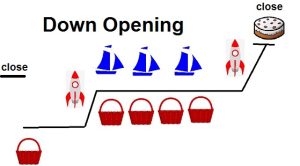

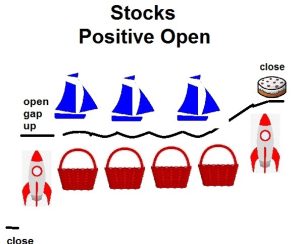

The two charts below are to the daily trading pattern that I over allude to. As long as these patterns occur on a regular basis, the averages are still being successfully managed.

As for myself, I am holding cash to make sure I have a chance to invest when it all falls apart. I hear people, all the time, talk about what is the right government policy to use in a debt based economy. They speak as if the debt based approach has any lasting utility to an economy. It doesn’t. It is a prescription for disaster.

Conservatives extract more benefit out of government spending than do liberals. So, don’t expect a return to sanity anytime soon.

The coming depression will be permanent. It takes free market influences to launch an economic recovery. There are so few of them left in the economy that a recovery is simply not possible.

Don’t expect a revolution to save the country. Those who would otherwise revolt, get too many benefits themselves, to make that approach worth their while.

Last but not least, the healthcare industry is in the hands of organized crime.

Views: 118